We aim to provide our clients with the right tools for their business and eliminate any hassle and worries you may have. Within Artisan Accountant & Co we use cloud based Accounting software Xero and the receipt scanning app Dext.

Xero

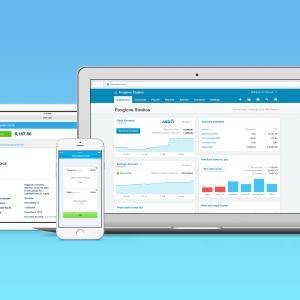

The advantages of using Xero and other cloud based packages enable you to work wherever you are. There is no need to be at a base computer, you can access the information anytime and anywhere on your laptop, phone or tablet.

There are no upgrades that you manually have to do – they are all done automatically.

The information is in Real-Time (RTI) meaning you will be able to make better informed decisions on how to run your business at the right time if everything is up to date.

Multi-user access allows you to collaborate effectively with your employees or accountant so they can jump in two when talking with you to see what you are looking at.

Depending on how you work there are opportunities to add-on applications which can link in with Xero. The list is endless, they are there to help you manage and grow your business. From receipt scanning to Cash flow forecasts and management reporting are just a small few.

Security

Security and the use of the internet for businesses are critical. The use of cloud accounting is as secure as your online banking. To help with this, Xero have setup two-step authentication checks to ensure you are protected to the highest level.

Xero have backup servers in various locations around the world so your data is never lost or destroyed.

Not used Xero before?

If you have never used Xero before, whether its Excel spreadsheets or alternative software, as a Xero Certified Advisor and Migration Advisor we can ensure you are setup with the right Xero package for you. Call us today to take a deeper look to get you started.

Along with Xero we also recommend:

Dext

To all our clients we offer the use of Dext within their bespoke package. By photographing on the app or emailing your receipts into your specific inbox for you, you no longer need to keep hard copies and can dispose of the lose slips of paper once we have confirmed everything has been received. This is stored in compliance with HMRC guidelines and means you are one step closer for Making Tax Digital.

All our meetings and software training are conducted through Zoom, MS Teams or Google Meet. This allows us to still work closely on your business and meet virtually rather than via a phone conversation.